2023 payroll tax calculator

Nanuet is located within Rockland County. The tax-free annual threshold for 1 July 2022 to 30.

2022 Federal State Payroll Tax Rates For Employers

Web The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

. Web The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The tax is collected by the New York State Department of.

Ad Simplify bookkeeping with Neats mobile accounting software storage. See where that hard-earned money goes - with UK income tax National. Web To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

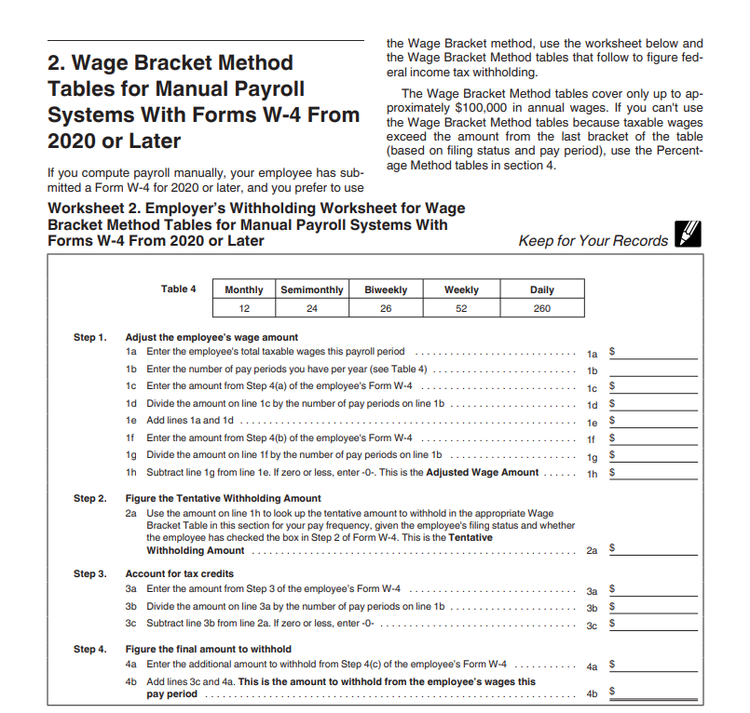

Web 2022 Federal income tax withholding calculation. Our W-4 Calculator can help you determine how to update your W-4 to get your desired. Web 2022 Federal income tax withholding calculation.

2022 Federal income tax withholding. Web The payroll tax rate reverted to 545 on 1 July 2022. Web Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Process Payroll Faster Easier With ADP Payroll.

Ad Process Payroll Faster Easier With ADP Payroll. Get Started With ADP Payroll. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Web FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Get Started With ADP Payroll. Automate reports gain business insights manage receipts expenses.

Prepare and e-File your. Ad Payroll So Easy You Can Set It Up Run It Yourself. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

Sage Income Tax Calculator. This includes the rates on the state county city and special levels. Web This calculator is for 2022 Tax Returns due in 2023.

Web Maine paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. Web The highest tax bracket is 6 while those making less than that are taxed at 44. Web Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time.

Free Unbiased Reviews Top Picks. Ad Compare This Years Top 5 Free Payroll Software. Discover ADP Payroll Benefits Insurance Time Talent HR More.

The standard FUTA tax rate is 6 so your max. Web The average cumulative sales tax rate in Nanuet New York is 838. Web This calculator is for 2022 Tax Returns due in 2023.

Web ADP processing week number Sunday Thursday If you make a schedule change please check your Payroll Schedule to be sure you use the correct week number. Print a record of federal. Well calculate the difference on what you owe and what youve paid.

The payroll tax rate reverted to 545 on 1 July 2022. Learn About Payroll Tax Systems. Web See your tax refund estimate.

Try out the take-home calculator choose the 202223 tax year and see how it. People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City. Web For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of.

The standard FUTA tax rate is 6 so. If youve already paid more than what you will owe in taxes youll likely receive a. Web The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

See how to file DIY Taxes on. Subtract 12900 for Married otherwise. All Services Backed by Tax Guarantee.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Quarterly Tax Calculator Calculate Estimated Taxes

Llc Tax Calculator Definitive Small Business Tax Estimator

How To Calculate Payroll Taxes For Your Small Business

Understanding The Aca Affordability Safe Harbors Health Insurance Coverage Affordable Health Insurance Safe Harbor

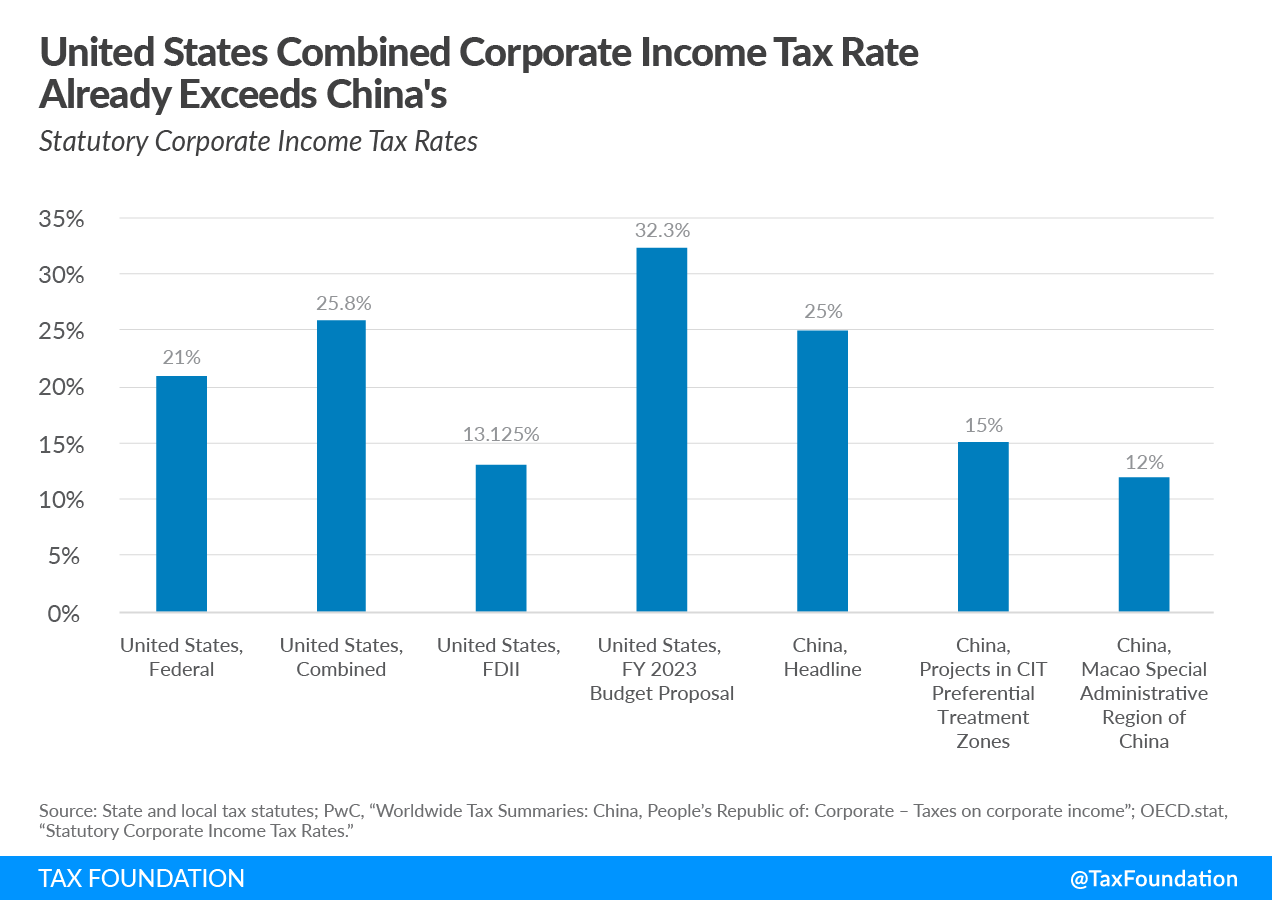

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Calculate Payroll Taxes For Your Small Business

Account Chart Bookkeeping Business Business Tax Deductions Accounting Education

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Us China Competition Usica Competes Act Corporate Tax Comparison

Estimated Income Tax Payments For 2022 And 2023 Pay Online

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

2022 Federal State Payroll Tax Rates For Employers

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

2022 Federal Payroll Tax Rates Abacus Payroll

Nanny Tax Payroll Calculator Gtm Payroll Services